Banks

Reinforcing trust through clarity.

Financial organisations operate in high-trust, regulation-sensitive environments where every message influences confidence. Digital Doctors begin with a structured diagnosis—evaluating clarity, risk communication, service interpretation, narrative accuracy, and trust signals before prescribing growth. The assessment identifies whether financial communication strengthens confidence or creates ambiguity. By analysing tone, compliance alignment, visual consistency, and customer sentiment, hidden gaps between financial capability and public understanding are exposed.

Reinforcing trust through clarity.

Communicating innovation responsibly.

Presenting strategy transparently.

Clarifying benefits and coverage.

Communicating risk and value precisely.

Strengthening service confidence.

Simplifying consumer understanding.

Presenting responsibility clearly.

Reinforcing professional credibility.

An audit evaluates how financial audiences perceive the brand in Columbus, highlighting unclear explanations, complex communication, and trust-impacting inconsistencies.

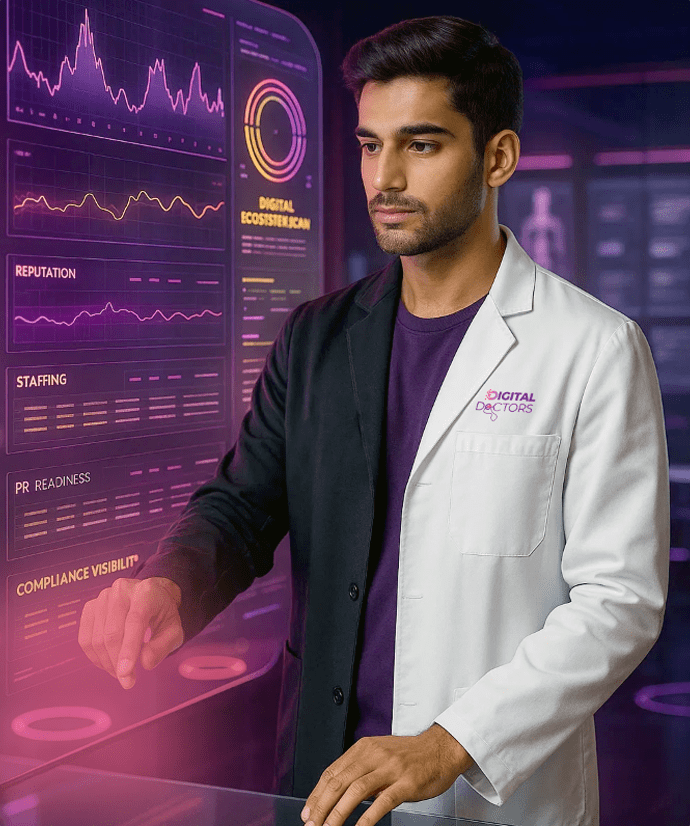

A comparative review across Ohio evaluates competitor narratives, clarity, risk communication, and differentiation to reveal what strengthens financial confidence.

All messaging is reviewed for responsibility, accuracy, and alignment with United States financial regulations and ethical communication standards.

Product teams, advisory teams, compliance departments, and digital platforms are analysed to ensure unified communication across all mediums in 2026.

Insights become structured recommendations that strengthen trust, clarity, and long-term financial credibility in Columbus.

For more than a decade, Digital Doctors have guided financial brands across United States, helping them communicate trust, responsibility, and financial clarity. Whether supporting emerging fintech firms or established banking institutions, the purpose remains constant: translate financial capability into trustworthy communication. Every engagement starts with diagnosis—revealing where public interpretation diverges from financial value. When clarity aligns with responsibility, trust becomes sustainable.

Presenting financial services with clarity.

Communicating innovation responsibly.

Translating investment strategies clearly.

Presenting protection benefits transparently.

Strengthening risk communication.

Reinforcing responsibility and clarity.

Presenting expertise with accuracy.

Communicating precision and integrity.

Explaining processes clearly.

Strengthening service confidence.

Finance brands in Columbus operate in competitive, fast-evolving environments where clarity determines confidence. Competitor mapping reveals where strong financial products are overshadowed by unclear messaging. Organisations are benchmarked across Ohio based on transparency, accessibility, service clarity, digital presence, and trust-building communication. Key Insight: Across 70 percent of financial audits, Digital Doctors identified at least three clarity gaps—each capable of improving trust, engagement, and conversion within one quarter.

Financial communication must be disciplined, accurate, and compliant. Digital Doctors craft responsible frameworks that strengthen clarity without overstating benefits. Each recommendation reinforces trust, aligns customer expectations, and protects long-term credibility.

Translating financial services into clear value.

Managing sensitive financial communication responsibly.

Explaining financial offerings with clarity.

Reinforcing financial trust across channels.

Finance brands adopting Digital Doctors’ frameworks achieved measurable improvements within six months :

Rise in trust-based visibility.

Improvement in meaningful financial engagement.

Increase in product or advisory inquiries.

ROI on responsible financial communication campaigns.

Core Authority Building Pillars :

Strengthening financial expertise through structured insight.

Publishing breakdowns of financial concepts, market trends, regulatory shifts, and advisory principles that position the brand as a dependable financial voice.

Reinforcing credibility through responsible exposure.

Securing presence across banking, fintech, business, and investment platforms where transparency and accuracy strengthen financial trust.

Communicating responsibility in financial operations.

Sharing clear narratives on ethical finance, responsible lending, sustainable investment practices, and long-term client value.

Building trust within financial and customer communities.

Engaging with clients, advisors, business networks, partners, and financial communities through clear, consistent communication that reinforces confidence.

Digital Doctors executed 7,500+ finance communication initiatives across United States. These strengthened visibility for banks, supported 200+ product launches, improved 870+ advisory narratives, and delivered 57M+ clarity-led impressions.

Performance Highlights :

Qualified inquiries across financial categories.

Video views within 30 seconds of launch.

Improvement in responsible financial engagement.

Financial markets supported with documented outcomes.

Digital Doctors uphold complete confidentiality—protecting financial data, advisory documents, compliance frameworks, product information, and communication assets.

From fintech to banking institutions, Digital Doctors ensure financial brands communicate with precision, build trust responsibly, and maintain long-term clarity.